Streamlining the Accounts Payable (AP) Process Flow

💡 Have you ever wondered how a simple purchase request transforms into a paid invoice, navigating various checkpoints along the way? For every organization, the Accounts Payable (AP) process is the backbone of financial operations, ensuring timely payments, maintaining compliance, and fostering strong vendor relationships. Let’s embark on a detailed journey through the AP process, step by step.

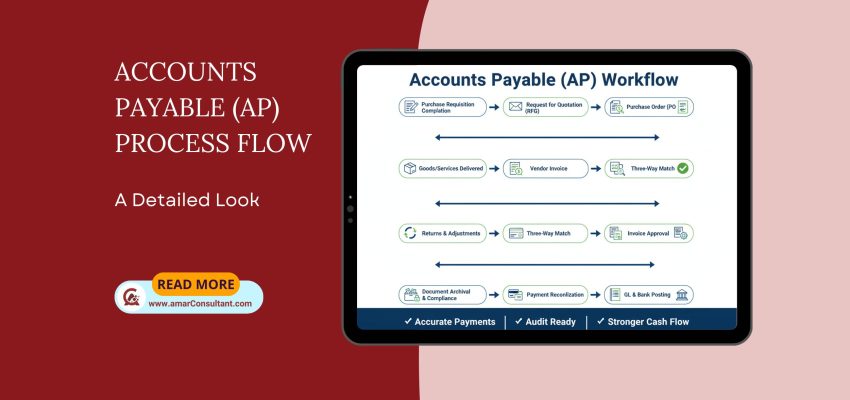

🔄 The Accounts Payable (AP) Process Flow: A Detailed Look

1. Purchase Requisition Raised 📝

The journey begins when a department identifies a need for specific goods or services. A formal purchase requisition is raised, either within an Enterprise Resource Planning (ERP) system or via a manual form. This request then undergoes internal approval by the relevant department manager, signaling the official start of the procurement cycle

2. Request for Quotation (RFQ) 📩

With an approved requisition in hand, the procurement team reaches out to multiple potential vendors. They invite these vendors to submit their detailed quotations, outlining pricing, specifications, and terms for the required goods or services.

3. Quotation Comparison & Vendor Selection 📊

This crucial step involves a thorough evaluation of all received quotations. Vendors are assessed based on a range of criteria including price, quality of goods/services, promised delivery timelines, and payment terms. The goal is to select the vendor that offers the best value and alignment with the organization’s needs.

4. Purchase Order (PO) Issued 📄

Once a vendor is selected, the company issues a formal Purchase Order (PO). This document serves as the official commitment to purchase from the chosen vendor, detailing the items, quantities, agreed prices, and terms.

5. Goods/Services Delivered 📦

Following the PO, the vendor delivers the ordered goods or performs the requested services. Upon arrival, the receiving team meticulously verifies the delivery against the Purchase Order to ensure accuracy and completeness.

6. Vendor Invoice Received 🧾

After delivery, the vendor sends an invoice for the goods or services provided. This invoice is then logged into the organization’s ERP system, crucially referencing the corresponding Purchase Order to link it to the initial transaction.

7. Three-Way Matching (PO + GRN + Invoice) 🔍

This is a critical control point in the AP process. The system automatically (or manually) cross-references three key documents: the Purchase Order (what was ordered), the Goods Receipt Note (GRN – what was received), and the Vendor Invoice (what was billed). An invoice can only proceed for payment if all three documents match perfectly, minimizing errors and preventing fraud.

8. Invoice Approval by Finance/AP ✅

The finance or Accounts Payable team then takes over. They meticulously verify all invoice details, assign the correct General Ledger (GL) codes for accurate accounting, and ensure compliance with all relevant tax regulations and company policies.

9. Returns & Adjustments (if any) 🔄

Should any goods be found defective, incorrect, or not up to standard, they are returned to the vendor. The vendor, in turn, issues a credit note to adjust the amount payable.

10. Payment Execution 💳

Once the invoice is fully approved, payment is executed according to the agreed-upon terms (e.g., Net 30, Net 45 days). Payments are typically made via bank transfer, cheque, or other agreed electronic methods.

11. Vendor Statement Reconciliation 📑

To maintain accurate records and prevent discrepancies, the AP team regularly cross-checks vendor statements against internal payment records. This ensures that no payments are missed or duplicated and resolves any variances promptly.

12. GL & Bank Posting 📘

The final financial entries are posted in the General Ledger, ensuring that all expenses and payments are accurately reflected in the company’s financial statements. Concurrently, these transactions are reconciled with bank statements to ensure alignment.

13. Document Archival & Compliance Check 🗂️

All supporting documentation—including Purchase Orders, invoices, Goods Receipt Notes, and payment proofs—are securely archived. This meticulous record-keeping is essential for audit readiness, regulatory compliance, and historical reference.

✅ Why Streamline Your AP Process?

An optimized Accounts Payable process offers significant benefits beyond just paying bills:

- Ensures Accurate & Timely Payments: Reduces late payment fees and strengthens vendor relationships.

- Minimizes Errors & Prevents Fraud: Robust controls like three-way matching are crucial for financial integrity.

- Keeps Audit Documentation Ready: Seamlessly navigate audits with well-organized and easily accessible records.

- Improves Cash Flow & Strengthens Supplier Trust: Predictable payments allow for better cash management and foster reliable supplier partnerships.

An efficient Accounts Payable process is more than just an administrative function; it’s a strategic pillar for building financial integrity, transparency, and strong supplier relationships. Businesses that proactively streamline their AP workflows, often leveraging automation and sophisticated ERP systems, stand to gain immense benefits—saving time, significantly reducing financial risks, and enhancing overall operational efficiency.

Author:

📞 Call Now: +8801734008136

🌐 Website: www.amarconsultant.com

📩 Email: info@atcsbd@.com